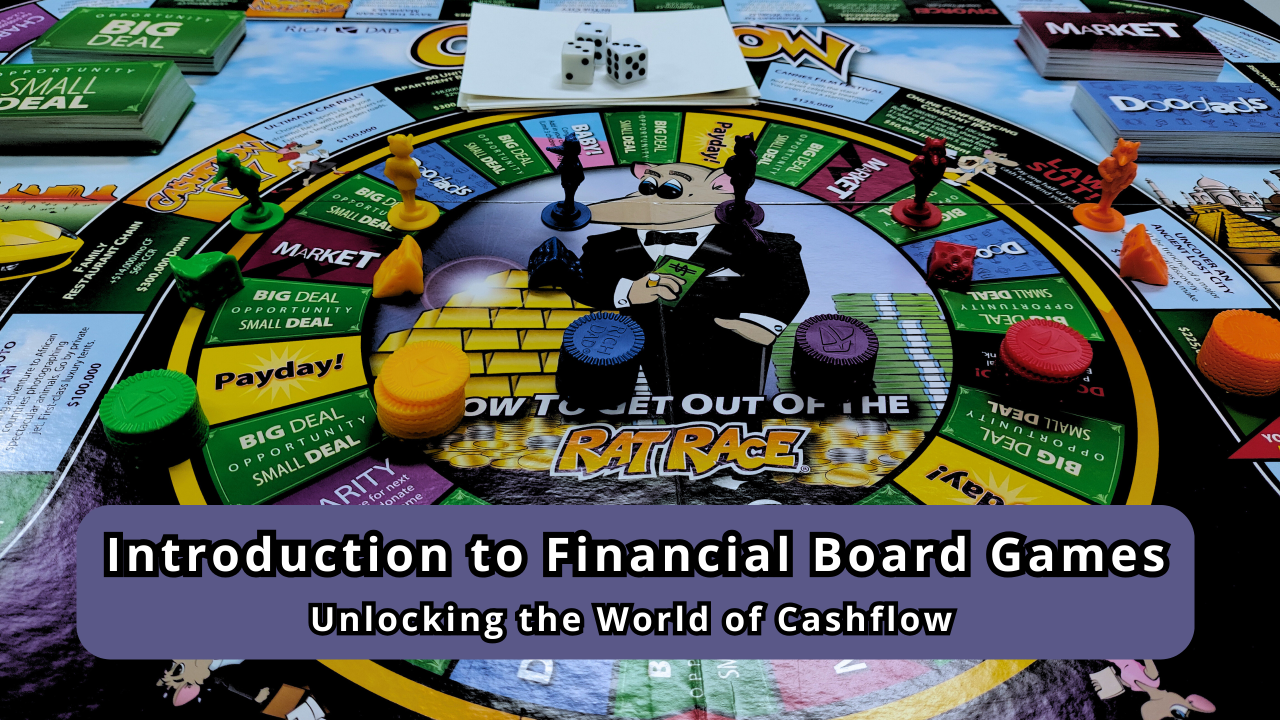

Introduction to Financial Board Games: Unlocking the World of Cashflow

In the ever-evolving landscape of financial education, traditional methods are taking a backseat to innovative and engaging approaches. Welcome to the world of financial board games, where learning about money management becomes an immersive and enjoyable experience. We explore one of the most renowned games in this genre – Cashflow.

The Board Game Revolution

Board games have been a source of entertainment for generations, but their role in education is experiencing a resurgence. Rather than a mere pastime, board games are now recognized as powerful tools for teaching complex concepts, especially in the realm of personal finance.

Cashflow, designed by Robert Kiyosaki, the author of the bestselling book "Rich Dad Poor Dad," stands out as a pioneer in this field. The game goes beyond traditional financial education methods by offering players a hands-on experience in navigating the world of investments, assets, and liabilities.

Understanding the Basics

At its core, Cashflow is a game of strategy and financial intelligence. Players roll the dice, make financial decisions, and navigate the ups and downs of the market. The objective? To escape the proverbial "rat race" by accumulating enough passive income to cover living expenses and achieve financial freedom.

The game introduces players to essential financial concepts:

1. Assets and Liabilities: Distinguishing between assets that put money in your pocket and liabilities that take money out is a fundamental lesson.

2. Investing: Cashflow encourages players to explore various investment opportunities, from stocks to real estate, emphasizing the importance of informed decision-making.

3. Financial Ratios: Understanding financial statements and ratios becomes second nature as players analyze their in-game financial positions.

Learning Through Experience

What sets Cashflow apart is its ability to transform theoretical knowledge into practical, applicable skills. Participants aren't just spectators; they actively make financial choices, face consequences, and witness the outcomes of their decisions.

As players progress through the game, they internalize the cause-and-effect relationships inherent in financial decision-making. This experiential learning approach fosters a deeper understanding of financial principles that might otherwise seem abstract.

Beyond the Board

Cashflow's impact extends beyond the confines of the game board. Players often find themselves applying lessons learned from the game to their real-world financial situations. The game becomes a bridge between theoretical knowledge and practical application, empowering individuals to take control of their financial destinies.

Join US

In the "Financial Board Games and Events", we invite you to join the conversation. Share your experiences with Cashflow, ask questions, and learn from the diverse financial journeys of fellow members. Together, we unlock the world of Cashflow and embark on a journey toward financial literacy and success.

Are you ready to roll the dice and make strategic financial decisions? Join us and explore the exciting intersection of finance and gaming. Let the learning begin!

#financialgamemaster #financialliteracy #financialgameevent #cashflowclubsingapore #cashflowgame